finance

Cloud repatriation might seem like a solution for high infrastructure costs, but it can prove short-sighted as an organization scales.

Which are the most profitable college athletic programs in the country? See a ranked listed, including total revenue and expenses. Brought to you by USA TODAY.

At Robinhood’s first annual Hood Summit in Miami, Sherwood Media’s Editor-in-Chief Joshua Topolosky sat down with Rebecca Kacaba, CEO and cofounder...

At The Money: BlackRock on Building a Bond Ladder (October 23, 2024) Full transcript below. ~~~ About this week’s guest: Karen Veraa is a Fixed Income Product Strategist within BlackRock’s Global Fixed Income Group focusing on iShares fixed-income ETFs. She supports iShares clients, generates content on fixed-income markets and ETFs, develops new…Read More

The ins and outs of how the mega-rich wall themselves off from government’s prying eyes

Jingjing invited me to her office and asked me to wait for her to finish work before we headed out to dinner together.[1] At the time, she was working in a third-party payment company—what, in the jargon of the money-laundering industry, is known as a ‘gateway’ (通道, tongdao). Like another similar enterprise I had previously […]

One way that first principles thinking fails is when you build your analysis up from a deficient set of base principles. Everything is correct and true, but you still end up mistaken. Here's how that looks like in practice.

In search of a status symbol, I wound up getting ripped off big-time. But the real scam is how America's payment apps treat their customers.

It’s hard to avoid hassle — or fraud — when you’re required to pay with paper and ink. Here’s why checks persist and why some people don’t mind.

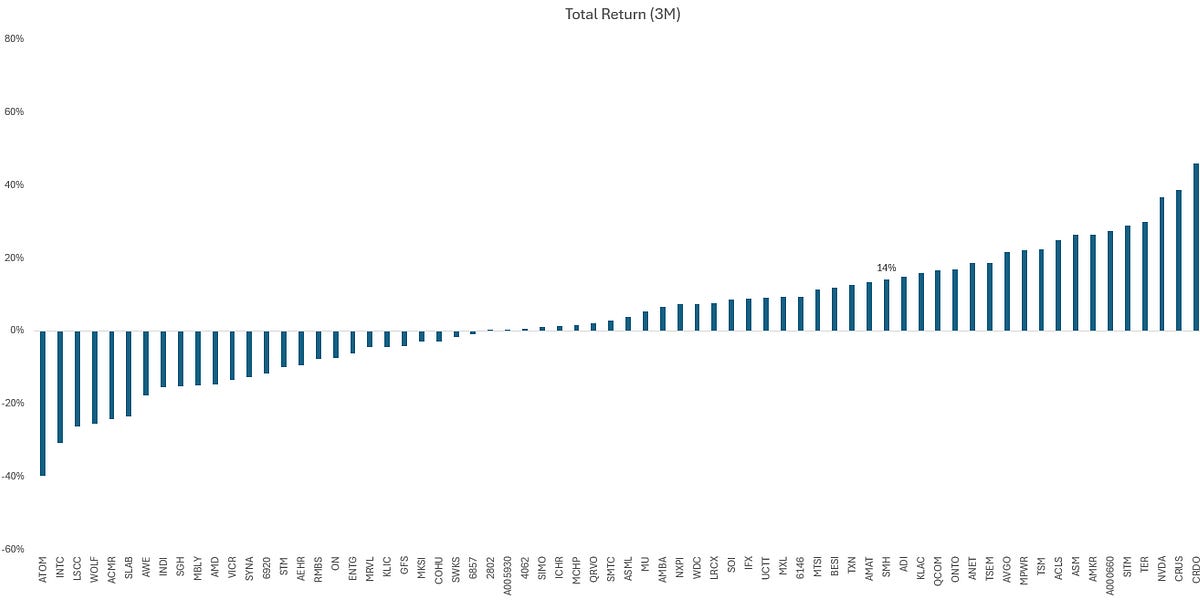

The AI bubble is reaching a tipping point. As we continue to follow the GPUs, navigating what comes next will be essential.

Here's everything that happened this quarter, and some thoughts and ideas.

How Danaher combines Lean manufacturing with masterful capital allocation to build a remarkable manufacturing company in the United States.

Credit card rewards are mostly funded out of interchange, a fee paid by businesses to accept cards.

Credit cards make money through net interest, interchange, fees, and marketing contributions.

In this article, I'll take you through a guide to some essential formulas for Data Science in finance with implementation using Python.

From the days of Drexel Burnham Lambert to the "Golden Age"

Investigating the financial transactions of an organisation can reveal details about its connections and funding. Here's a quick guide on how to do it.

Involved in international trade? U.S. custom regulations can lead to cost savings, compliance benefits, and a smoother trade process.

A superb video on the history and mathematics of options pricing from Veritasium.

LIMITED-TIME OFFER : $119 instead of $185Who is this course forFor finance and accounting professionals who want to level up its career by gathering crucial expertise in finance management, budgeti...

In 2022 and 2023, US IPOs hit decade lows after the record high of 2021. Now, in 2024, will the IPO window reopen? In this episode, we revisit a conversation with Jeff Jordan, former CEO of OpenTable, and J.D. Moriarty, the former Head Managing Director and Head of Equity Capital Markets at Bank of America...

Moscow may be trying to help Pyongyang with access to the international financial system in exchange for missiles and ammunition, U.S.-allied intelligence officials suggest.

Introducing the Rule of X — this new cloud metric is an adjusted form of the Rule of 40, taking composition (and weighting) into account.

At my first company, I internalized the standard advice to never think about M&A. The consensus was, and is, to just keep growing the business and good things will come. I did that, and I was lucky that good things did come in the form of a $130M acquisition

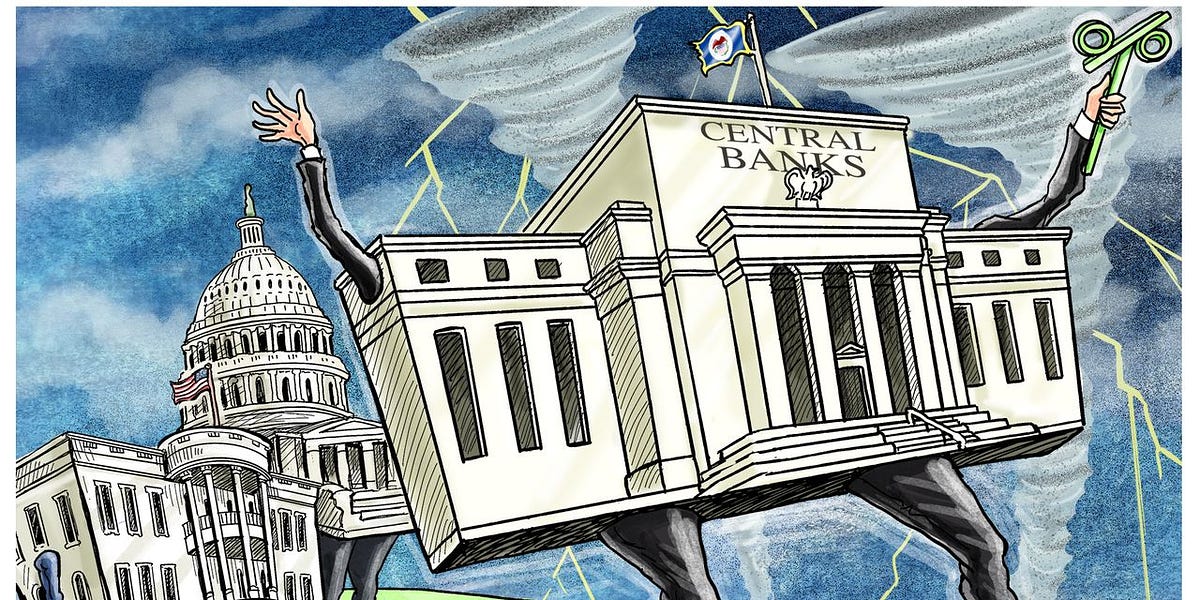

Central Banking 101, Joseph Wang (Self-Published, 2021) The greatest gift bestowed by admittance to elite institutions is that you stop being overawed by them. For instance, there was a time when upon hearing “so-and-so is a Rhodes Scholar”, I would have assumed that so-and-so was a very impressive person indeed. Nowadays I know quite a lot of former Rhodes Scholars, and have seen firsthand that some of them are extremely mediocre individuals, so meeting a new one doesn’t phase me much. My own

Automate complex business processes with Nanonets' intelligent automation AI. Draw actionable insights from unstructured data across multiple sources.

Why the Best Way to Make Something Affordable is to Send it Around the World a Few Times

The text of Pricing Money, J. D. A Wiseman, Wiley (2001)

We trace Michael Dell's skill at the art of capital in business, and use it to examine how skill at capital allows you to make moves that aren't available to a novice business operator.

ACH transactions happen every day, but how do they work? We break down the anatomy of an ACH transaction to help you understand the role they play in your banking product.

Large language models have increased due to the ongoing development and advancement of artificial intelligence, which has profoundly impacted the state of natural language processing in various fields. The potential use of these models in the financial sector has sparked intense attention in light of this radical upheaval. However, constructing an effective and efficient open-source economic language model depends on gathering high-quality, pertinent, and current data. The use of language models in the financial sector exposes many barriers. These vary from challenges in getting data, maintaining various data forms and kinds, and coping with inconsistent data quality to the crucial

Spot trouble early in a volatile environment with forensic accounting.

Research suggests a fascinating link between the physical world and how investors price stocks.

The long read: A series of financial scandals have rocked Italy’s most glamorous club. But is the trouble at Juventus symptomatic of a deeper rot in world football?

How bid density impacts ads, recommender systems, and salary negotiations.

The things you need to know and the things you can ignore, at the early stage of your company’s journey.

Arthur Hayes rubbed success in the Feds’ face and got busted. Now he’s returning to a shell-shocked industry.

The tech company Wirecard was embraced by the German élite. But a reporter discovered that behind the façade of innovation were lies and links to Russian intelligence.

I really enjoyed reading Algorithmic Trading: A Practitioner’s Guide by Jeffrey M. Bacidore. Before starting, I imagined it would cover various strategies for trading in the markets, along th…

Richard Bookstaber was Salomon Brothers’ chief risk officer in 1997 when the firm was bought by Travelers and merged with Smith Barney, Travelers’ retail brokerage. He describes the resulting clash of cultures.

Heirs to an iconic fortune sought out a wealth manager who would assuage their progressive consciences. Now their dispute is exposing dynastic secrets.

Jane Street is a quantitative trading firm and liquidity provider with a unique focus on technology and collaborative problem solving.

Too many CEOs don't understand capital allocation. They rose up through the sales or operations ranks, and now that they are at the top they have to wing it with respect to one of the most important aspects of running the business. Don’t get me wrong – there are some amazing capital allocators among

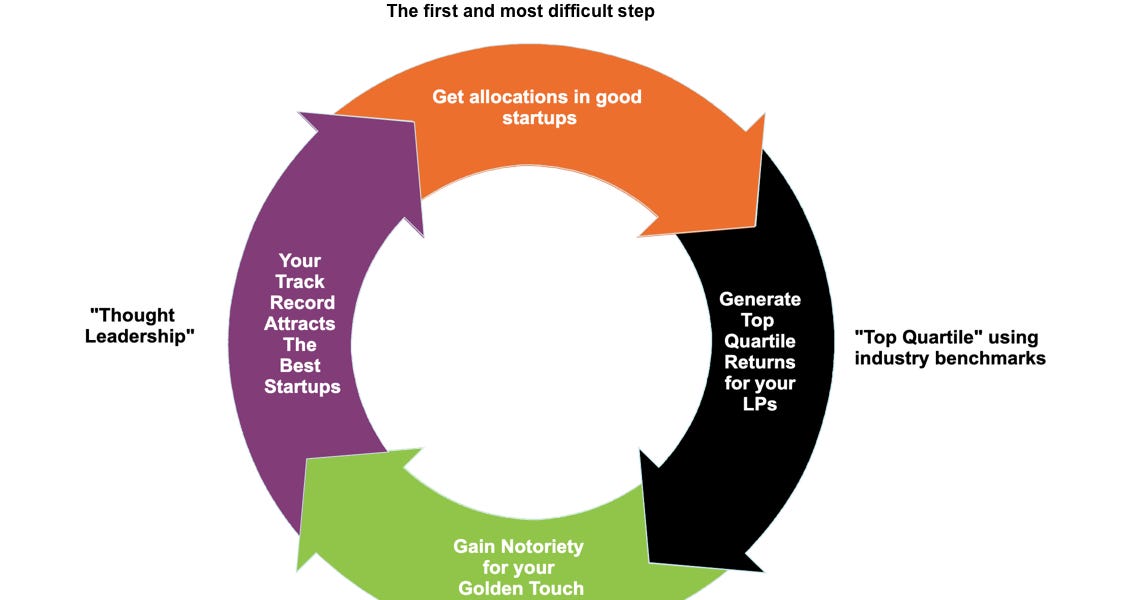

We’ve noticed a common problem: founders don’t know what “good” looks like in a term sheet. This makes sense, because it is often, literally, the first time in their careers that they’ve seen one. This puts founders at a significant disadvantage because VCs see term sheets all the time and know what to expect. Because we’ve invested in so many founders over the years and have seen hundreds of Series A term sheets, we know what “good” looks like. We work with our founders to understand where term

Once revered as the safest way to store physical valuables, safe deposit boxes are now being phased out by major banks.

The Krugerrand is a popular gold coin that is minted in South Africa and distributed to buyers around the world. Krugerrands contain 22 karat gold, an alloy of 91.67 percent gold and 8.33 percent copper.

A New York Times #1 BestsellerAn Amazon #1 BestsellerA Wall Street Journal #1 BestsellerA USA Today BestsellerA Sunday Times BestsellerA Guardian Best Book of the 21st CenturyWinner of the Financial Times and McKinsey Business Book of the Year AwardWinner of the British Academy MedalFinalist, National Book Critics Circle Award "It seems safe to say that Capital in the Twenty-First Century, the magnum opus of the French economist Thomas Piketty, will be the most important economics book of the year--and maybe of the decade."--Paul Krugman, New York Times "The book aims to revolutionize the way people think about the economic history of the past two centuries. It may well manage the feat."--The Economist "Piketty's Capital in the Twenty-First Century is an intellectual tour de force, a triumph of economic history over the theoretical, mathematical modeling that has come to dominate the economics profession in recent years."--Steven Pearlstein, Washington Post "Piketty has written an extraordinarily important book...In its scale and sweep it brings us back to the founders of political economy."--Martin Wolf, Financial Times "A sweeping account of rising inequality...Piketty has written a book that nobody interested in a defining issue of our era can afford to ignore."--John Cassidy, New Yorker "Stands a fair chance of becoming the most influential work of economics yet published in our young century. It is the most important study of inequality in over fifty years."--Timothy Shenk, The Nation

In the mid-’80s, Wall Street turned to the quants—brainy financial engineers—to invent new ways to boost profits. Their methods for minting money worked brilliantly… until one of them devastated the global economy.

When valuing a company, investing in a three-statement financial model pays off.

Two months after the startup went bankrupt, administrators have summarized the $80M+ debt the company has accumulated, most of which will not be paid. The highest offer to buy Pollen’s business assets - but without its liabilities - currently stands at only $250K. Details.

While the industrial technology sector is undervalued and underappreciated, it actually offers a bright economic future. By Nick Santhanam, Fernweh Group While the industrial technology sector is undervalued and underappreciated, it actually offers a bright economic future.

Plus! Watercooler Shows; Smart Thermostats; Substitutes and Complements; Monetization; Apple Ads; Diff Jobs

Plus! Pensions; Customer-Facing; Use Cases; Making a Market; Reflexive Energy Politics; Diff Jobs

Those who survived had to go beyond simply saving more and spending less.

Royalty Exchange is an online marketplace & auction platform where investors & owners of royalty streams can buy royalties and sell all types of royalties.

Royalty Exchange is a marketplace where investors can buy income-generating intellectual property and other royalty streams as alternative investments.

A close look at the costs that go into running Cushion and the reasons why we use specific services.

Content curation is the process of gathering content — blog posts, images, videos — from a variety of sources. Sharing relevant information with your

SG&A Benchmarks SG&A Expense as a Percentage of Sales by Industry Sector Industry Sector 10% ile Median 90% ile Agriculture, Forestry, Fishing 5.54 36.96 237.02 Mining/Extraction 2.21 7.29 143.32 Construction 5.82 9.85 19.81 Manufacturing 8.44 33.23 248.16 Transportation, Communications, Utilities 2.80 15.55 52.69 Wholesale Trade 3.52 17.86 112.27 Retail Trade 7.83 27.26 70.28 Finance, Insurance, Real Estate 5.15 31.43 69.19 Services 12.14 42.20 146.35 All sectors combined 6.04 30.65 146.32 The series of PDF reports SG&A Benchmarks is the source for the above data. They serve as a convenient source of information for professional managers seeking benchmark information on the Selling, General & Administrative spending practices of major public corporations within a specific industry sector. SG&A expenses are composed of all the commercial expenses of operation incurred in the regular course of business pertaining to the securing of operating income. Any portion of these expenses that the company itself allocates to cost of goods sold will not be included in SG&A. SG&A expense includes advertising expense, commissions, engineering expense, marketing expense, selling expense including salaries of the salesforce, employee benefit expenses, software expense, administrative office expense and other expenses related to sales but not included in cost of goods sold. Frequently SG&A to Sales ratios are used to judge overhead or cost of sales. Since different industries vary significantly in their practices of classification of expenses considered to be reported within SG&A expense, SG&A Benchmarks is produced for individual industry sectors. SG&A spending practices may also vary with size and country so information on annual sales and headquarters city is provided. The industry sector summary displays median SG&A to Sales ratio by industry to illustrate the range of values reported by firms within the industry. The tables for each individual industry present SG&A as a percentage of sales and the annual percentage growth rate in SG&A spending as well as in sales for each company within the industry. Comparing the growth rate of SG&A expenses and sales gives a snapshot of where the profitability of the firm may be heading. The firms are presented in three groups as defined by sales of less than $100 million, sales between $100 million and $1 billion, and sales of more than $1 billion. Two sets of industry tabulations are presented. Alphabetical order by company name aids in locating a firm. Order by SG&A to Sales ratio showcases the ‘leaner and meaner’ firms in each industry. This report will benefit anyone seeking competitive benchmark intelligence including: corporate staff, financial analysts, investment professionals, lenders, M&A advisors, appraisers and industry consultants. Click on the sector of interest below for more details, including a sample page, table of contents, and ordering information.

Some years ago, I was explaining to my manager that I was feeling a bit bored, and they told me to learn how to read a Profit & Loss (P&L) statement. At the time, that sounded suspiciously like, “Stop wasting my time,” but operating in an executive role has shifted my perspective a bit: this is actually a surprisingly useful thing to learn. The P&L statement is a map of a company’s operation and is an effective tool for pointing you towards the most pressing areas to dig in.

A curated list of practical financial machine learning tools and applications. - firmai/financial-machine-learning

The New Standard Source of Industry-level Analysis The 2015 Valuation Handbook ‒ Industry Cost of Capital includes cost of capital estimates (equity capital, debt capital, and weighted average cost of capital, or WACC) for over 200 U.S. industries, plus a host of detailed statistics that can be used for benchmarking purposes,Don't Forget the Quarterly UpdatesThe hardcover 2015 Valuation Handbook - Industry Cost of Capital includes U.S. industry data updated through March 2015. This critical analysis is updated quarterly with data through June, September, and December. Ensure that you are using the most up-to-date data and information available: add the Quarterly Updates and keep your data library current. For more information about Duff & Phelps valuation data resources published by Wiley, please visit www.wiley.com/go/valuationhandbooks.Also Available 2015 Valuation Handbook - Guide to Cost of Capital 2015 International Valuation Handbook - Guide to Cost of Capital 2015 International Valuation Handbook - Industry Cost of Capital Key Features Over 200 U.S. industries analyzed: The 2015 Valuation Handbook ‒ Industry Cost of Capital provides comprehensive, detailed industry-level analyses that can be used for benchmarking purposes. Over 200 U.S. industries organized by standard industrial classification (SIC) code are presented. Up to 8 separate cost of equity and WACC estimates, plus cost of debt, by industry: The 2015 Valuation Handbook ‒ Industry Cost of Capital provides cost of equity capital and WACC estimates for each industry using multiple estimation models (various build-up models, CAPM, CAPM adjusted for size, 1-stage and 3-stage discounted cash flow (DCF) models, and Fama-French multi-factor model). Cost of debt is also estimated for each industry. Industry and peer group betas: The 2015 Valuation Handbook ‒ Industry Cost of Capital provides levered and unlevered beta estimates for each industry (e.g. ordinary-least squares (OLS) beta, sum beta, downside beta, etc.), plus peer group betas adjusted to the industry average based upon statistical quality. Additional industry statistics: The 2015 Valuation Handbook ‒ Industry Cost of Capital provides detailed statistics for sales, market capitalization, capital structure, valuation (trading) multiples, financial and profitability ratios, equity returns, aggregate forward-looking earnings-per-share (EPS) growth rates, and more. Analysis of off-balance-sheet debt: The 2015 Valuation Handbook ‒ Industry Cost of Capital includes a separate analysis of "off-balance-sheet" debt by industry (capitalized operating leases and unfunded pension liabilities), Analysis of high-financial-risk companies: The 2015 Valuation Handbook ‒ Industry Cost of Capital includes a separate analysis of "high-financial-risk" companies by industry. Quarterly Updates are (i) optional, and (ii) not sold separately. Quarterly Updates are delivered in PDF format only.

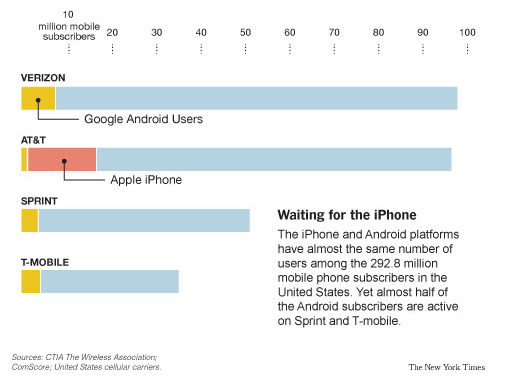

Apologies in advance: If you’re fluent in the language of accounting, please skip to the bonus Verizon iPhone feature at the end. What I’m about to describe will strike you as oversimplified and…

We’ve noticed a common problem: founders don’t know what “good” looks like in a term sheet. This makes sense, because it is often, literally, the first time in their careers that they’ve seen one. This puts founders at a significant disadvantage because VCs see term sheets all the time and know what to expect. Because we’ve invested in so many founders over the years and have seen hundreds of Series A term sheets, we know what “good” looks like. We work with our founders to understand where term

Twitter went mad last week because somebody had transferred almost $150m in a single Bitcoin transaction. This tweet was typical: There was much comment about how expensive or difficult this would …

[Follow Me on Twitter] “ Don't you know that you are a shooting star, And all the world will love you just as long, As long as you are.” -- Paul Rodgers, Shooting Star With the IPO market now blown wide-open, and the media completely infatuated with frothy trades in the bubbly late stage private market, it is common to see articles that reference both “valuation” and “revenue” and suggest that there is a correlation between the two. Calculating or qualifying potential valuation using the simplistic and crude tool of a revenue multiple (also known as the price/revenue or price/sales ratio)…

Understanding financial statements - Download as a PDF or view online for free

Ignore the haters: living standards have improved a lot since the 1980s.

After a year of reporting on the tax machinations of the ultrawealthy, ProPublica spotlights the top tax-avoidance techniques that provide massive benefits to billionaires.

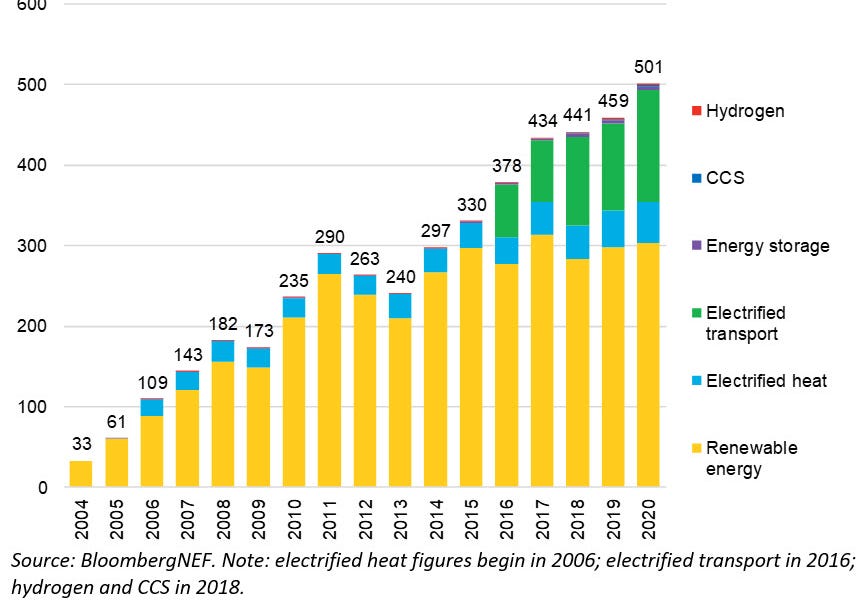

Plus: Hydrogen pipelines, Advanced Market Commitments, and what made solar energy cheap

One of the big subjects of discussion in the banking industry earlier this year was the publication of the Millennial Disruption Index, stating that millennials view banks as irrelevant and placing traditional retail banking at the highest risk of disruption compared to other B2C industries. Accenture's Banking 2020 report confirms this and draws a parallel to the challenges the telecom industry faced 20 years ago and states that non-banks will take a third of incumbent banks revenues by 2020.

The ubiquitous dollar store is the American dream writ small.

Americans are rightly angry about inflation. A strong labor market is not enough reason to celebrate. But, we are coming out of, not going into the hurricane.

As cryptocurrencies have plunged, attention has focused on a potential point of vulnerability: the market’s reliance on a so-called stablecoin called Tether.

Plus, with Revlon’s bankruptcy, Wall Street bankers get ready for a wave of distressed situations.

Financial gurus want young home shoppers to stop complaining and cut back on small luxuries. But there are broader affordability issues at play.

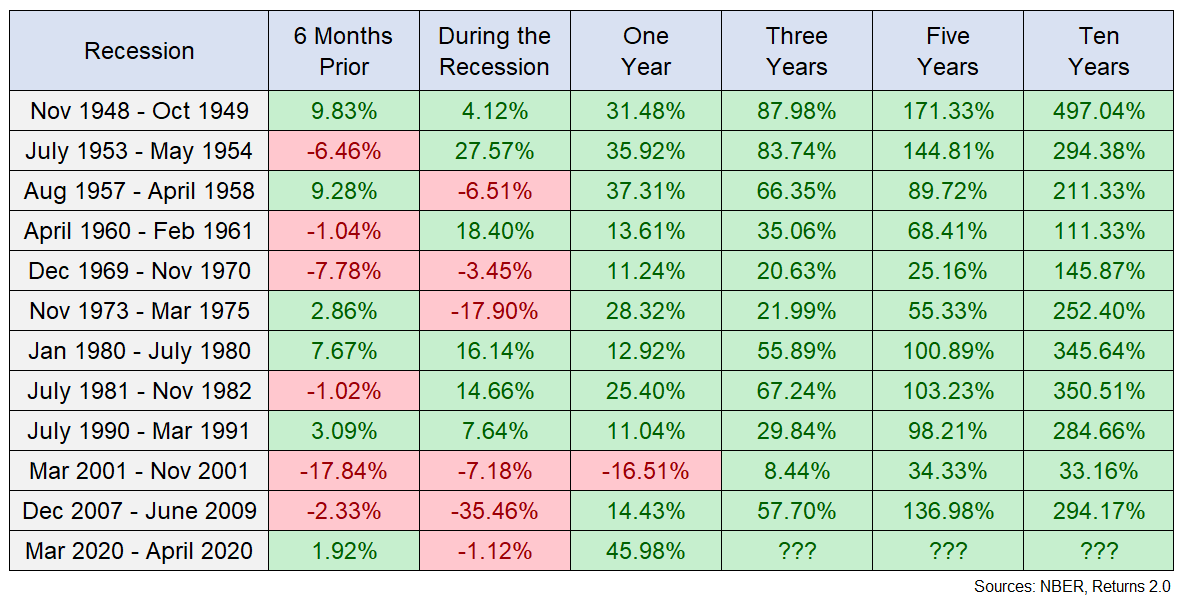

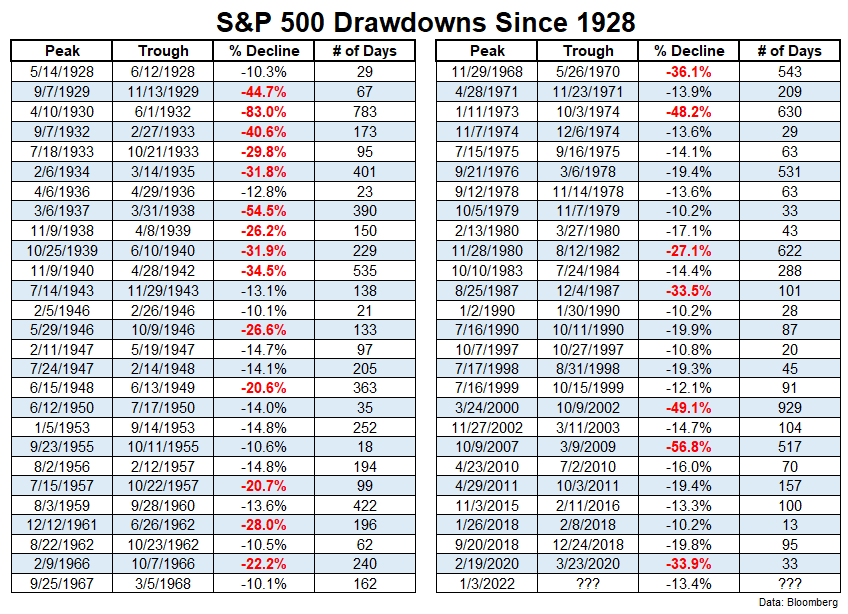

It's not always easy to predict the timing of a recession and what that means for the stock market.

Although we are not technically in a bear market (the S&P 500 Index has not declined 20%) it absolutely feels like one. The tech-heavy NASDAQ index is 26% off its highs, and so are small-cap stocks. Many of the darling stocks of the latest growth rally have been decimated. These are some of the most...

:max_bytes(150000):strip_icc()/INV_HousingMarket_GettyImages-1262902106-730be6d8cef8442a94c8fb623fb28bf1.jpg)

Capital gains taxes on real estate and property can be reduced or not assessed when you sell your home, up to certain tax limits, if you meet the requirements.

Roger Lowenstein’s “Ways and Means” offers a fresh perspective on the Civil War by explaining the importance of financing.

Now he’s pulling the strings, and raking in hundreds of millions, from a blockchain rage called DeFi, which promotes the fantasy of democratized financial services.

Build in minutes. Deploy in seconds. Quant workflow reimagined. Built by developers for developers 🚀

Metrics surround us. Whether you're building the next big thing and need to measure customer churn,...

This blog post is in response to a recent topic on the Parallella forum regarding Adapteva’s chip cost efficiency (GFLOPS/$): [forum discussion thread]. I had to be a little vague on some poi…

Bank transfers have exploded as a payment method in India and may become more common in much of the world.

Engine No. 1’s victory in a boardroom battle with ExxonMobil is taking ESG investing to the next level.

One fintech veteran from India found out the hard way why “Mexicans love cash.”

The inside story of a black sheep hedge fund, a massive bet that shopping malls would crash, and how they proved Wall Street wrong.

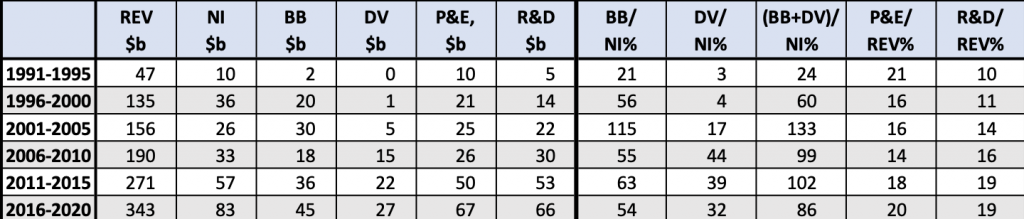

Intel is the poster child of how stock buybacks come at the cost of technological innovation.

Let’s Build a Chip – We lay out the costs of building a chip – with spreadsheets!

To be honest, the title of the article does quite a good job in describing what Quantra actually is. It’s a platform that helps potential students with their journey of learning about quantitative…

Retailers who want to measure the full value of their physical stores need to consider factors in addition to in-store sales.

Greensill Capital promised a win-win for buyers and sellers, until it all fell apart, igniting concerns about opaque accounting practices.

He earned a fortune at Goldman Sachs, but now the banker wants the financial sector to reassess its values and tackle the climate emergency

On making optimal decisions, when to expect the average outcome in life, and when not to.

As CEO of Occidental Petroleum, Vicki Hollub made the biggest deal the oil business had seen in years. Will it also go down as the biggest failure?

:max_bytes(150000):strip_icc()/GettyImages-2164244046-64f9853c96bb46f78938aaecb5dd7b42.jpg)

Most websites with a stock quotes service offer free short interest data. Learn more about what shorting information means and how to find it.

Ten things that guide almost everything I think about in business and investing…

Advice, insight, profiles and guides for established and aspiring entrepreneurs worldwide. Home of Entrepreneur magazine.

In a SPAC IPO, a shell company goes public with a pledge to investors that it will eventually become a traditional company via acquisition.

One way that first principles thinking fails is when you build your analysis up from a deficient set of base principles. Everything is correct and true, but you still end up mistaken. Here's how that looks like in practice.

I recently read Debt: the First 5000 Years by David Graeber, and it has stuck on my mind for a while. It’s one of those “Everybody is wrong about X, here is what you’ve missed in plain sight” -type…

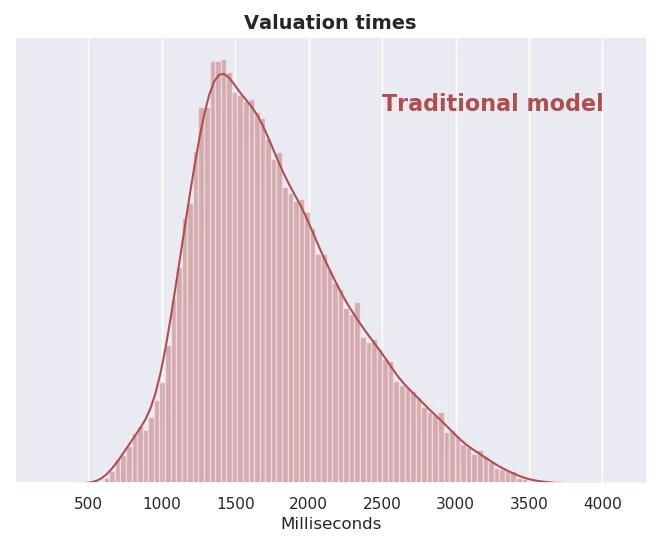

We recently collaborated with Riskfuel, a startup developing fast derivatives models based on AI, to measure the performance gained by running a Riskfuel-accelerated model on the Azure ND40rs_v2 Virtual Machine instance powered by NVIDIA GPUs against traditional CPU-driven methods.

Hi, Welcome to BIG, a newsletter about the politics of monopoly. If you’d like to sign up, you can do so here. Or just read on…

The Black–Scholes /ˌblæk ˈʃoʊlz/[1] or Black–Scholes–Merton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments. From the parabolic partial differential equation in the model, known as the Black–Scholes equation, one can deduce the Black–Scholes formula, which gives a theoretical estimate of the price of European-style options and shows that the option has a unique price given the risk of the security and its expected return (instead replacing the security's expected return with the risk-neutral rate). The equation and model are named after economists Fischer Black and Myron Scholes. Robert C. Merton, who first wrote an academic paper on the subject, is sometimes also credited.

Valuation concerns are top of mind for many investors. For those in tech investing, this concern is perhaps most acute, given the generally high multiples assigned to the sector. There are good articles addressing how revenue multiples have moved over time or why this methodology even came to be, but I'm still curious as to how a revenue multiples ties to some fundamental unit of company value.

Build models better. Causal replaces spreadsheets with collaborative modeling in the browser.

The Medallion Fund, an employees-only offering for the quants at Renaissance Technologies, is the blackest box in all of finance.

Collection of notebooks about quantitative finance, with interactive python code. - cantaro86/Financial-Models-Numerical-Methods

Liberty Reserve was like PayPal for the unbanked. Was it also a global money-laundering operation?

The subprime lending giant is a textbook case in creating a corporate culture of denial.

It’s common for companies to hang on for too long to projects or parts of the business that are underperforming. Two effective techniques can help executives make project investment decisions on when to hold on to an asset and when to let it go.

505 votes, 61 comments. 2M subscribers in the finance community. Welcome to r/Finance! No Personal Finance, Homework, Personal blogs, or…

The true story of how the City of London invented offshore banking – and set the rich free

When a secretive private equity firm bought Remington, sales were strong and the future bright. A decade later, the company couldn’t escape its debts.

A secretive hedge fund used the British court system to punish an IP thief‚ even though he was already in jail.

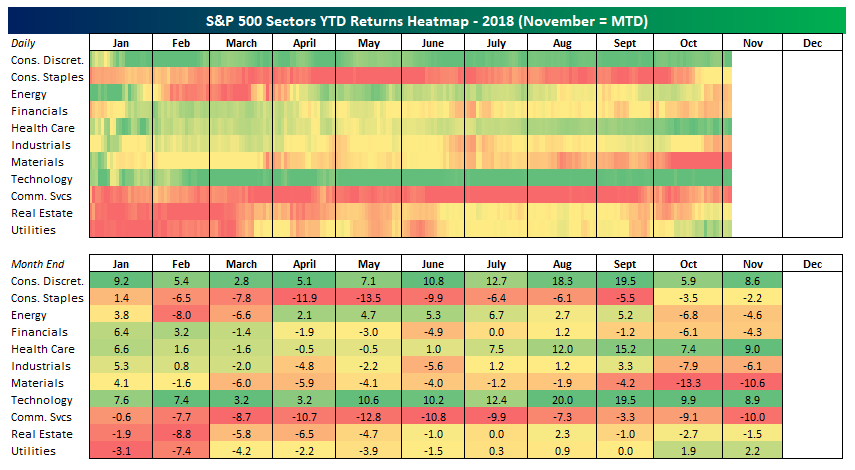

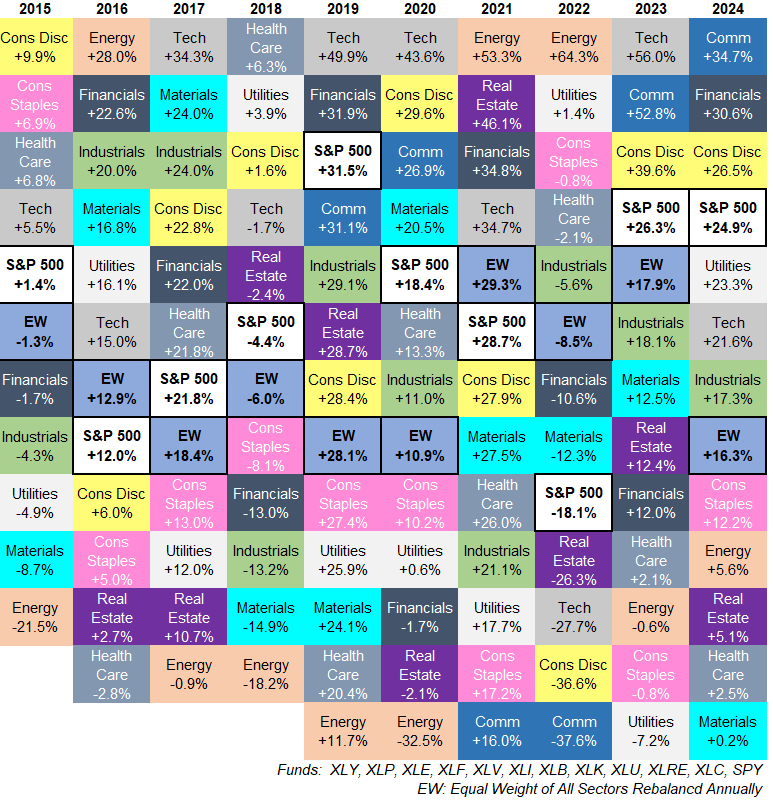

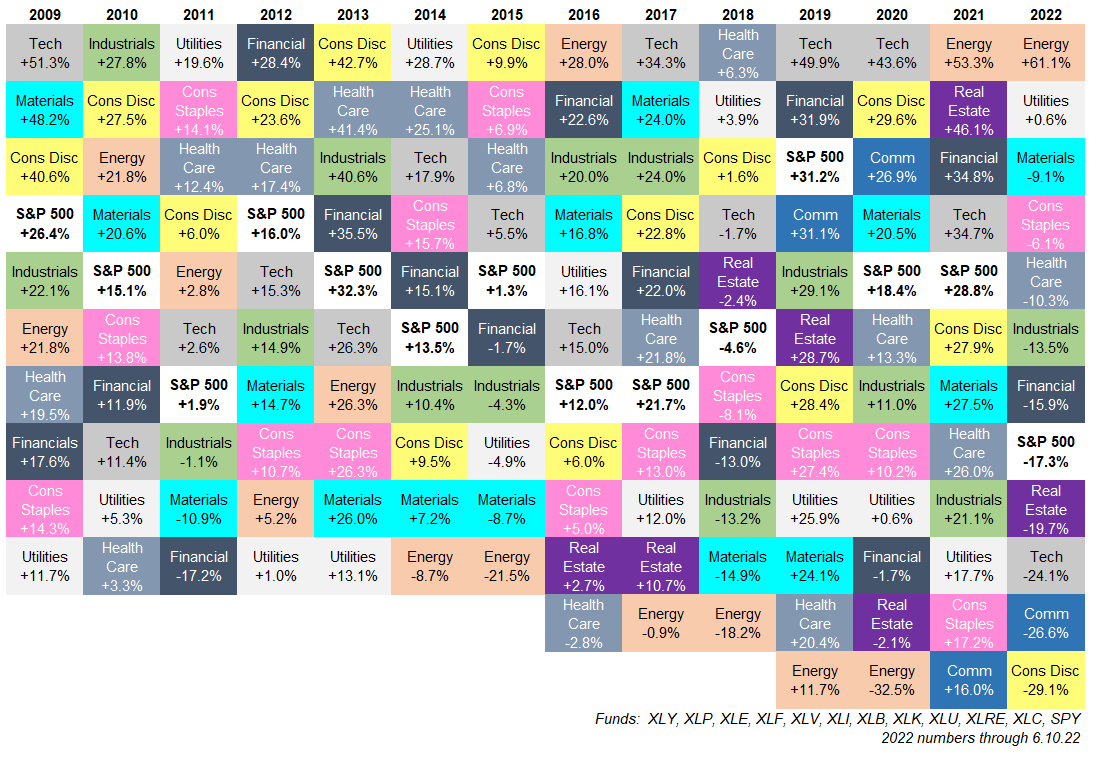

Stock market rotation has been a pretty big theme this year but you wouldn't necessarily know it from our sector performance heatmap.

Robert Smith is the Founder, Chairman, and Chief Executive Officer of Vista Equity Partners. A March 2018 Forbes profile described Vista’s performance: “Since the firm’s inception in 2000, Vi…

There are certainly some people who don’t know that Caddyshack is a 1980 comedy movie directed by Harold Ramis and written by Brian Doyle-Murray, Douglas Kenney and the director Ramis.…

The capital budgeting process involves applying the time value of money concepts to business investment decision making. It is critical towards ensuring that capital is invested into the right projects.

I don’t think anyone would disagree that building a successful hardware business has quite literally many more moving parts than software.

Cost cuts, stressed employees, intercompany rivalries, dirty floors, dusty rafters, glitchy IT, fudged metrics: The people who ran the failed toy retailer's stores know what went wrong.

Originally published at https://www.datacamp.com/community/tutorials/finance-python-trading

Blatant forgery. Snarling guard dogs. Shredded evidence. An incendiary cache of leaked documents reveals the farcical scramble inside one of the world’s dirtiest banks to conceal incriminating information from US government investigators – while some of the most prestigious accountants and lawyers on the planet used all their power to keep the bank in business.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23152618/1230608869.jpg)